Online banking has become very common nowadays, and one of the aspects of online banking is that it can be done anywhere, anytime, even while you are not in your own country or at an airport. But, while doing so, you must be cautious as your details and finances might be vulnerable to attack.

If you rely a lot on internet banking to make or receive payments or conduct many online purchases, you must use a VPN for internet banking. Banking transactions involve many sensitive data such as your bank account number, credit/debit card details, and many such things. And, someone with malicious intent may have eyes set on such details. There is no denying that most banks have stringent security protocols to protect your bank accounts; there are times when hackers can easily barge in.

Which is where a VPN comes in. In this blog, we’ll discuss when you should certainly use a VPN for internet banking and when VPN won’t help you –

What Is A VPN?

A VPN or Virtual Private Network helps conceal your IP address and your online data. It routes your web traffic via your chosen VPN service provider’s server. A VPN establishes an encrypted tunnel between you and its remote server. All your web traffic then travels through this tunnel. During this process, your IP address that appears changes, and so does your location.

Now that you have a fair idea of how a VPN conceals your IP address and masks your web activity let’s weigh instances when you should use a VPN for banking.

But First, Which VPN Should I Use For Online Banking?

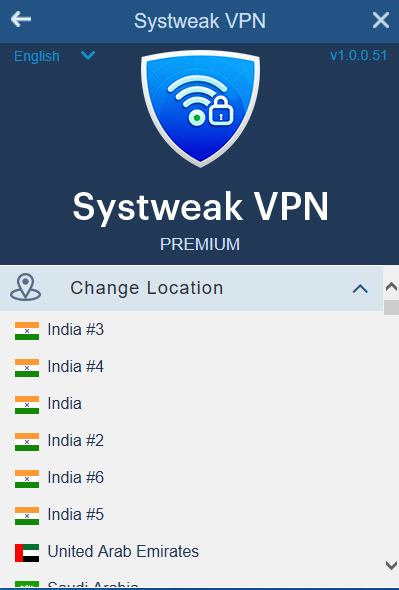

There are several great VPNs, but one of the most trusted and credible VPNs is Systweak VPN. Here is a complete review of the Systweak VPN. Let’s look at some of its features, making it one of the best options to conceal your online identity.

|

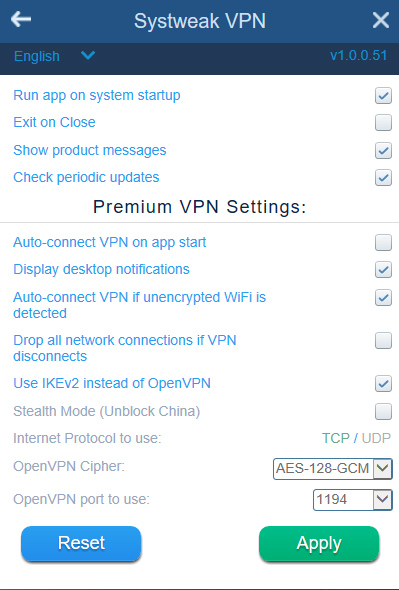

Systweak VPN – Features At A Glance

|

|

Windows versions supported: 10/8.1/8/7 Price: $ 9.95/ month or $ 71.40/ year Money-Back Guarantee: 30 days money-back guarantee Special Deal: With the yearly plan, you get 12 Months + 3 Months |

When Should I Use VPN For Online Banking

1. VPN Would Protect You While You Are Using A Public Wi-Fi

Performing a banking activity such as transferring funds or making a payment online can be risky while using a public-Wi-Fi, especially if it is not password protected. In such cases, an imposter may just create a fake “free-Wi-Fi” and extract all your personal and banking details.

With the help of a VPN, you can encrypt your traffic, which means no prying eyes will be able to see your bank details. This would further make it impossible for a prospective hacker to steal your identity or even money.

Moreover, all major VPN service providers such as Systweak VPN have a strict no-logs policy, which means none of your browsing history or online activity will neither be monitored, nor will it be disclosed.

2. VPN Even Protects Your Banking App

Banking these days is not just confined to physical branches. Most banking activities such as viewing banking statements, issuing checks, paying installments, transferring funds can be done right from your smartphone using an app.

This means you can conduct banking anywhere using a dedicated mobile app of a bank on your smartphone. While a bank leaves no stone unturned to secure your data, a VPN adds a further layer of security. It helps you, especially when you are using payment gateways to conduct transactions and receive critical details such as OTP.

Also Read: How Is Artificial Intelligence Transforming Mobile Banking?

3. VPNs Can Be Helpful When You Are Baking Online While Traveling

Sometimes banks closely monitor your IP addresses when you are travelling abroad. This way, they keep tabs on your banking activity and how you access your accounts while you are in some other country.

In most cases, this is a legit practice, and you shouldn’t hide your banking activity, yet there are times when you might just lose access to your account. You can then use a VPN, connect to a server in your own country, and conduct transactions without the fear of losing access to your bank account.

4. Most VPNs Have Kill Switch

Kill switch is one of the benefits of using a VPN. You might wonder what’s with a kill switch, and how can it protect you while you are banking online?

A kill switch essentially is a feature of a VPN service provider which monitors internet connection for change in IP address. If due to some reason, the internet connection drops, the kill switch will also block your computer or phone from connecting to the internet until the VPN connection is restored.

Let’s say you are using VPN for banking online but suddenly, the connection drops. At that time, the kill switch will immediately terminate the session, meaning none of the details from that transaction will be exposed.

While VPN and online banking is a great and advisable combination, there are few instances when VPN for online banking might not help you.

When VPN For Online Banking Might Not Help You

1. When Your IP Address Appears From A Country Not recognized By The Bank

Sometimes when you are trying to use a VPN for conducting an online banking transaction and appear from a different country and an unrecognizable IP address, your bank might perceive it as fraud and thereby block your VPN.

2. When You Are Using An Untrusted Or Free VPN

In case you are using a free or non trusted VPN service, it might not be of help. Such VPN providers provide a small number of VPN servers, have bleak encryption standards, and deliver slow speeds. Plus, some of these service providers may even sell your data to third parties, some of whom might even inject malware into your system.

3. When You Use A Weak Password

There is a reason why it is insisted that you use a strong password for all your online banking accounts. That is because if you have a weak password, a hacker can easily break into your internet banking account, and then a VPN cannot come to your rescue.

Conclusion

Safety during online financial transactions cannot be stressed upon. We highly suggest using a reliable VPN like Systweak VPN when conducting online transactions, especially on Public Wi-Fi or while traveling abroad. If you liked the blog, do upvote it and share it with your friends and family. You can also find us on Facebook and can subscribe to our YouTube channel.

Subscribe Now & Never Miss The Latest Tech Updates!

Subscribe Now & Never Miss The Latest Tech Updates!