If you’re complaining about mismanagement in your business operations while being dependent on long excel sheets for keeping track of your capital, taxes, and salaries of your employees, then you are the one to blame. As your business grows, so does your operation scale, which requires a more extensive employee base, capital flow, and expenses. And with money flowing in and out of accounts, a business needs to keep in check and calculate taxes, sustain timely payments, and contributions of the company to employee allowances. These are just some of the few things associated with the management of business capital, and you can’t do it error-free with just manually created excel sheets.

Payroll Management Software is designed to automate these processes and help you track the capital flow in and out of your business without errors. If you need to ensure that you never miss out on payments, or make manual calculations errors, while paying taxes and salaries to your employees, then you can consider one the following payroll management software and choose the one that suits your business organization. So, here are some of the best payroll software that can handle capital management for you:

List of The Best Payroll Management Software

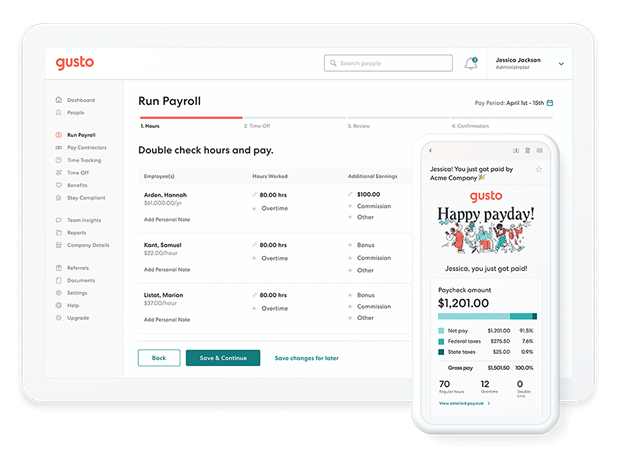

1. Gusto

Gusto is one of the best payroll management software with loads of features to maintain employees’ salary accounts, automatic filings and deductions, and other allowance expenses. It’s an integrated platform which can be merged with other e-payroll systems such as Xero and QuickBooks, which are used to maintain company accounts. This means that your employees’ salaries and your other expenses can be tracked altogether.

Besides, Gusto’s payroll management system also gives individual account access to employees, which allows them to track their salaries, tax filings and deductions, and benefits on a single platform.

Key Features:

- Automatically files for payroll taxes and deducts accurate amounts for individual attendance.

- The payroll management software has a time-tracking feature which decides the exact number of paydays for employees.

- Separates company expenses in employee benefits, allowances, medical services for detailed payroll analysis and statistics.

- Allows individual access to employees and sustain transparency between the company and employees regarding payroll concerns.

- Can be integrated with accounting software like QuickBooks.

- Help in creating offer letters, team surveys, etc. for Human Resources purposes.

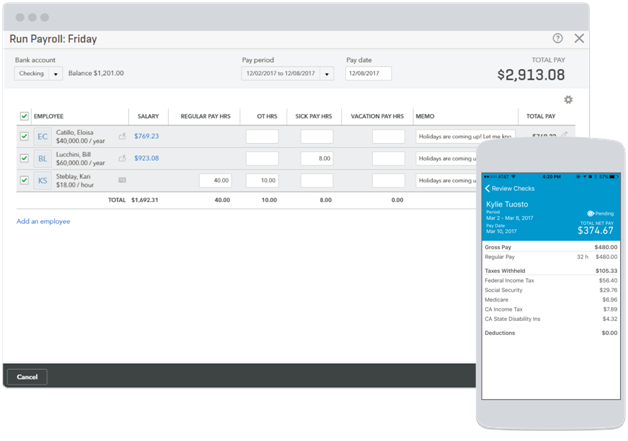

2. Quickbooks Pro

QuickBooks payroll management system offers a wide range of integrations, and it’s probably one of the most convenient e-payroll systems to use. QuickBooks have tens of products in the field of automated accounting, capital flow management, and business expense management. With QuickBooks payroll software, you can sustain a single, integrated platform that will manage most of the finance-associated concerns of your business.

It is best payroll management software if you’re looking for an overhaul of capital flow monitoring in all forms both in and out of your company accounts.

Key Features:

- Automated calculations for paychecks and taxes

- Has a feature for workforce portal wherein employees can view their salary payments and monitor withholding allowances.

- Manage workers’ compensation and other benefits.

- The other QuickBooks integrations allow for complete capital flow management within a business organization.

- The HR Support Center is a portal that helps the business comply with federal wage policies, learn hiring practices and other onboarding tools.

Read More: Best QuickBook Alternatives for Business Accounting

3. Run by ADP

Run has categorized its services in four different plans. These plans cover services ranging from basic e-payroll system to enhanced payroll management system combined with human resource services as the plan upgrades the services upgrades with them.

The four plans are:

- Essential Payroll: Basic e-payroll system offering salary management and tax filings.

- Enhanced Payroll: Has added features for insurance compliances and other benefits offered to employees with their annual salary packages.

- Complete Payroll: Has a separate module for HR services such as training toolkits, onboarding wizards, forms and documents etc.

- HR Pro Payroll: Claims to offer enhanced support, third-party legal assistance etc.

Key Features:

- Run offers all payroll management system services such as tax filing, payroll deliveries, W-2s, and new hire reporting.

- Run works across platforms and can be accessed via mobile/computer application or the web.

- The HR services provided in the higher plans of Run includes support for an automated employee hiring documentation, online profile databases, and employee appraisal reports.

- Other features are additional offerings such as HR toolkits, training modules etc.

4. On Pay

One of the best payroll management software, On Pay, is a perfect choice for both startup companies and large businesses with multiple departments. While the payroll software supports payroll services such as tax filings, payment monitoring, and payment schedules, it also offers to handle payments made to contractors and temporary employees under a categorized database management system.

The e-payroll system also allows for multiple integrations of different accounting software and time-tracking platforms, along with many HR services.

Key Features:

- Manage multiple payment schedules for different employees and contractors.

- Maintain a database for different modes of payments and transactions.

- Integration of accounting and time-tracking systems for accurate calculations and management of cross-platform capital flow.

- Produces automated offer letters and HR documentation for easy communication between the company itself and the employees scattered among different departments.

- Chat feature to communicate with employees through a mobile app.

5. Wave Payroll

Wave is best known because it is free payroll management software and is a complete package of accounting services, sales management, and a payroll management system within a single platform. Wave is widely used for its extensive accounts management and easy monitoring of cash flow and profit/loss margins.

However, the employee payroll system is Wave’s one of the best business software feature. But payroll features majorly include essential monitoring of timely salary payments, tax deductions and filings, etc. and these expenses are automatically calculated along with other costs.

Key Feature:

- Wave Payroll is an overall capital management software with an integrated payroll management system.

- The software supports all major payroll tasks such as salaries, employee database, tax deductions, information on paydays and pay cuts, etc.

- Is free of cost and has no hidden charges.

- Statistical monitoring of data makes it easier for administrators to analyze cash flow and payroll expenses.

Read More: Best Enterprise Resource Planning Software for Entrepreneurs

6. Xero

Xero Payroll is integration to Xero’s accounting software. However, it can be separately used as the payroll management software. Besides all the payroll management services, Xero offers an intuitive and easy-to-understand experience to its users. The e-payroll system has got features like time-sheets for managing employee attendance, pay calendars, monitoring of reimbursements, leave management etc.

All these additional features over payroll features like salaries employee database makes the software more comprehensive and automated. The Xero mobile app further offers employees a transparent view of their payslips, leaves, timings, etc.

Key Features:

- Xero comes with an in-package payroll management system but can also be purchased as separate business software.

- Xero payroll management software offers single-touch payroll, wherein salaries are credited to employee accounts directly via integrated bank accounts.

- Xero has additional features to monitor work timings and leaves.

- Xero has a built-in calendar which can help scheduled automated payments to employees.

- The Xero mobile app allows employees to track their work timings, leaves, and payslips as well.

- Integration with Xero Accounting will merge salaries as outgoing expenses and will, therefore, create a wholly integrated capital flow management system for the business.

7. Zenefits

A combined HR and Payroll Management software that offers monitoring and management of salaries, salary changes, employee work timings, leaves, etc. The features on Zenefits does not slowly distinguish from the other entries on the list, but it certainly outmatches a few in terms of user interface and ease-of-use. Besides leave management and time-sheets, Zenefits also takes account of employee benefits to create an accurate and detailed payslip for employees and tax filings.

Key Features:

- Salary changes are automatically synced.

- Employee benefits are taken into account.

- Work timings and leaves are effectively managed.

- Employees can request leaves directly from the app.

- The onboarding process is automated via Zenefits’ HR services.

8. Patriot Payroll

For small to medium business owners, whose employee base is up to a hundred people, Patriot is the best payroll software. It’s intuitive, reasonably priced, and has loads of features, which will help you get through all payroll and tax filing tasks automatically. The software has an employee portal to track their pay and leaves, as well as has a feature of direct salary deposit from connected bank accounts.

Patriot promises to fill in all sorts of taxes automatically, including federal payroll taxes, deposit taxes, year-end filings, etc. The accuracy in tax deductions and other calculations is what Patriot is known for

Key Features:

- Is specifically designed for small and medium businesses.

- Can only manage employee portals for one hundred employees.

- Is accurate in tax deductions and promises automated tax filings for all employees.

- Can be integrated into dedicated accounting software to maintain a complete e-payroll system.

- Offers direct salary deposits and printing of checks.

- Monitor time-offs for employees and can maintain a separate database for contractors.

- Can manage pay deposits in different time-rates.

Read More: Best Invoice Software for Generating Bills

9. Sage Business Payroll

Sage Business Payroll is one of the business software offered by UK’s Sage Group, who deals in automated accounting, expenses, and inventory management. Sage Business Payroll is an exclusively designed payroll management system for small businesses holding an employee base of not more than 25 people.

The payroll management software is a basic e-payroll platform without many fancy features besides monitoring timely and accurate deposits of employees’ salaries adjusted with tax deductions. The system creates an automated payslip as it calculates wages and offers an intuitive and transparent payroll management service.

Key Features:

- An intuitive payroll software designed for small businesses.

- Can manage salaries of up to 25 employees.

- Is purely a payment management software offering monitoring of salary deposits and tax deductions.

- There are additional features for tax filings and reporting, as well as the employee leaves management for accurate salary calculations.

- Companies can send direct payment reports as well as payslips via email to the employees from Sage.

- Payment rates can be sent at either weekly, fortnightly, and monthly.

10. Paychex

Paychex is an all-in-one HR and Payroll management software, which offers services like managing employee payrolls, hiring and onboarding, and employee attendance. Paychex has complete compliance for IRS regulations and taxes and is effective in required tax filings and automatic tax deductions from individual employee salaries. The HR services ensure that employees’ issues are efficiently handled and dealt with professionalism and care towards them. Paychex has got five significant features, as mentioned below.

Key Features:

- Payroll: Monitor salary deposits for all employees.

- Human Resources: Help employees get human resource assistant directly on the portal.

- Hiring & Onboarding: Automate documentation for hiring processes of new employees.

- Benefits: Monitor expenses generated in the form of employee benefits such as retirement, extra allowances, bonuses etc.

- Time & Attendance: Manage employee work timings and leaves for salary calculations.

Payroll processing is one of the most challenging tasks in business operations as it has got a lot of money flowing out of the accounts. Moreover, it has to be accurate because as a business, you can’t ever afford errors in tax filings and break some federal rule in doing so. These payroll management software tidy up the entire process of employee payroll and tax filings and automate most of the work to reduce errors and establish accuracy. For all small and large businesses, such platforms for payroll management are essential as they keep steady track of employee pays and keep a record of expenses generated in care of them from company accounts.

Read More: Top 10 Project Management And Communication Tools

Tell us, as a business owner, which of these payroll management software will you choose depending on the size of your business. And for more information on such software solutions, follow WeTheGeek on Facebook, Twitter, and YouTube.

Subscribe Now & Never Miss The Latest Tech Updates!

Subscribe Now & Never Miss The Latest Tech Updates!